- L-Plate Retiree

- Posts

- Planning to Live to 100 (And Why That's Not Crazy)

Planning to Live to 100 (And Why That's Not Crazy)

because retirement doesn’t come with a manual

i plan to take this photo in a few decades

So, I'm planning to live to 100.

This little declaration tends to drop into conversations like a conversational hand grenade. The responses are predictably grim: "Why would you want to live that long?" or "What's the point when you can't even wipe your own nose?" Cheerful bunch, my friends.

Here's what fascinates me—in almost everyone's mind, aging automatically equals decline. They picture wheelchairs, adult diapers, and someone else cutting up their food. Sure, if that's your definition of "living," then sign me up for the early checkout. But here's the thing: is that decline really inevitable?

The Numbers Don't Lie

Let's talk statistics. People are living longer whether they planned for it or not. Here in Singapore—officially declared a "Blue Zone 2.0" in 2023—the average lifespan is around 84. That's not wishful thinking; that's data.

Then there's genetics. Look at your parents. How long did they stick around? Those genes are swimming in your DNA right now, potentially adding years to your earthly subscription whether you asked for them or not.

And then there's science. Some tech billionaire is reportedly spending $2 million annually trying to hack his way out of dying altogether. While most of us can't afford that particular midlife crisis, remember my dad's daily pill regimen? Maybe longevity hacking is more accessible than we think.

The Real Question Isn't "How Long?" But "How Well?"

The odds are stacked in our favour to live longer. The question is: what are we going to do with all that extra time?

These bonus decades come with some rather pressing questions:

What will you actually DO with 20-30 years of post-career life?

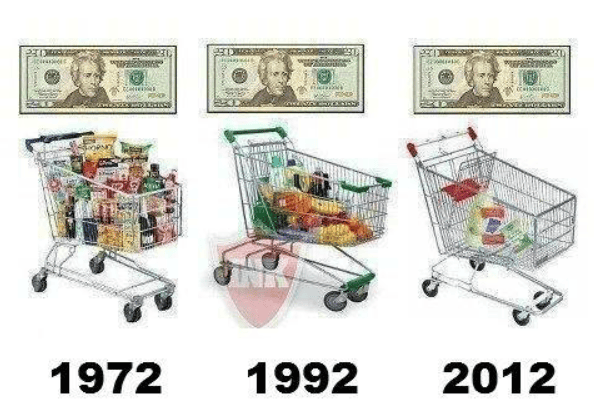

Will your money last as long as you do?

Will you thrive, or just survive on autopilot?

Here's the uncomfortable truth: dying is guaranteed, but truly living isn't. A fun, engaging, productive life doesn't just happen because you managed not to die. It requires intentionality, planning, and—dare I say it—some actual effort.

The Five-Plate Juggling Act

This is why we're here, exploring those five plates we all need to keep spinning: Personal Finance, Investing, Health, Fitness, and Lifestyle. Because living to 100 isn't just about adding years to your life—it's about adding life to your years.

The alternative? Spending three decades wondering where the time went and why nobody prepared you for the longest phase of your life.

Your Turn

So here's my question for you: How long are you planning to live? And more importantly, what are you doing today to make sure those years are worth living?

Drop a comment below and let me know! I'd love to hear your thoughts—whether you're planning for 80, 90, 100, or just taking it one day at a time. What's your biggest concern about those extra years? What excites you most about them?

Because if you're going to be around for the long haul anyway, you might as well make it interesting. And we might as well figure it out together.

Time Value of Money (Why a Dollar Today Beats a Dollar Tomorrow)

Here's a question that sounds like a trick: Would you rather have $100 today or $100 in a year? If you answered "today," congratulations—you understand the time value of money without even trying.

Money today is worth more than the same amount in the future because of what you can do with it in the meantime. That $100 today could be invested and potentially become $107 next year (assuming a 7% return). Meanwhile, that future $100 is just... $100.

This concept explains why retirement planning can't wait until you're 55. Every year you delay is a year of potential growth you're giving up. It's also why those "get rich quick" schemes are usually nonsense—real wealth building takes time, and time is your most valuable asset.

L-Plate Takeaway: Procrastinating on investing is like showing up late to a party where they're giving away free money. You can still join, but you've missed some of the good stuff.

Subscribe now to receive weekly insights, practical tips, and occasional humour to help you prepare for or thrive in retirement. Unlike those other financial newsletters that seem written for people who already understand everything, we speak human here. No jargon without explanation, no assuming you've been investing since kindergarten.

Become one of our founding subscribers who are refusing to let retirement happen to them—they're happening to retirement instead! Being part of something from the beginning means you'll help shape where we go next.

Because retirement doesn't come with a manual... but now it does come with this newsletter.

The L-Plate Retiree Team

(Disclaimer: While we love a good laugh, the information in this newsletter is for general informational and entertainment purposes only, and does not constitute financial, health, or any other professional advice. Always consult with a qualified professional before making any decisions about your retirement, finances, or health.)

Reply