- L-Plate Retiree

- Posts

- When Markets Fall – Why Timing the Drop Isn’t the Real Game & What You Can Do Instead

When Markets Fall – Why Timing the Drop Isn’t the Real Game & What You Can Do Instead

Understanding inevitable market corrections and choosing your own plan for investing and income

because retirement doesn’t come with a manual

Today’s article resonated deeply and reminded me of Apr’s “Liberation Day”. My portfolio just hit an all-time-high a month or two earlier, but that fateful day brought a painful, unplanned correction. Worse, I was afraid to get back in and missed the almost immediate rebound the weeks that followed. #stilllearning

Markets drift into cautious territory as tech-valuation worries take the stage

The quick scan: Monday’s session wrapped with markets tilting toward the downside. Investor sentiment was muted as many chose to wait on the sidelines, rather than push forward aggressively. The mood was less about a panic rush and more about hesitation, as traders weighed ahead-of-time risks rather than immediate gains.

S&P 500: -0.92% to 6,672.41 – extending recent softness

Dow Jones Industrial Average: -1.18% to 46,590.24 – led the decline with broad blue-chip pressure

NASDAQ: -0.84% to 22,708.07 – tech and AI stocks stumbled slightly under renewed scrutiny

What’s driving it: The main tether to the market’s mood today was concern. Not dramatic fear, but the kind that makes you tighten the belt just a notch. High-flying tech and AI names ran into valuation friction and weaker momentum. The upcoming earnings of a major chip-maker loomed large, and the delayed release of key US economic data (thanks to recent shutdown disruptions) added to the uncertainty. Investors seemed to quietly ask: “What happens if things don’t go quite as planned?” That question, more than any cheer or churn, is what drove the tone.

Bottom line: For L-Plate Retirees this means: it’s a moment to stay steady rather than swing for the fences. The market isn’t signalling collapse, but it’s also not setting off fireworks. Use this quiet as an opportunity to check your portfolio – are your guardrails still set for your stage of life? Are you comfortable with your balance between growth, income and risk? It’s less about bold moves and more about calm alignment.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

The Market Will Eventually Fall – Here’s How You Can Prepare (Without Panic)

what’s your plan for the next market fall?

The scoop: Every so often, a headline floats by reminding us that the stock market will, at some point, fall. Not might. Will. It’s one of the few things in investing that comes with a warranty. Markets rise, wobble, rise again, get a little too pleased with themselves, and then eventually take a tumble.

But instead of treating that downturn like a catastrophe, there’s a gentler, more grounded way to think about it – especially for those of us in the L-Plate Retiree community. A market fall isn’t a sign that you’ve done something wrong. It’s simply the bill coming due for the privilege of enjoying the years when markets went up. Volatility is the price of admission.

The tempting response is to say, “Fine, then I’ll sell before it drops.” It sounds sensible, almost responsible – like sweeping the porch before a storm. But the moment you step out of the market, a new worry creeps in. What if the rally continues? What if dividends keep rolling in without you? What if the market doesn’t correct for six months... or two years? Suddenly the tidy plan becomes a chorus of what-ifs.

And even if you do step out successfully, you’re still left with a trickier question: when do you get back in? The world always looks scarier during a fall than it does in hindsight. Prices are low, yes, but headlines are loud, nerves are frayed and every instinct says, “Maybe wait just a little longer.” Before you know it, the market is recovering without you, and the tidy plan is back in pieces.

All of this circles back to the one question that actually matters: what are you investing for? Because your answer to that shapes everything – how much volatility you can stomach, whether you value dividends over price movement, whether you prefer slow-and-steady income or long-term compounding, and how much you care about timing versus participation.

When you’re clear on your purpose, a market fall becomes less of a threat and more of a weather pattern. You may not enjoy it, but you know it will pass, and you know what you’re doing while it does.

Actionable takeaways for L-Plate Retirees

Name your goal. Decide whether you’re seeking income, growth, preservation or some blend. It’s easier to stay calm when you know what you’re aiming for.

Understand your trade-offs. Selling to avoid a fall may feel smart in the moment, but it often means giving up dividends, compounding and the quiet confidence that comes from staying invested.

Prepare your portfolio for bad weather. Diversification, adequate cash buffers and steady income sources can make a downturn feel like an inconvenience rather than a crisis.

Acknowledge your human side. It’s easy to say you’ll buy when prices fall. It’s much harder when fear is high. Set rules or reminders that help you act with intention, not emotion.

Let time do its work. Your investing horizon matters. Even in retirement, most people have decades ahead. A portfolio that can ride through multiple cycles is often more forgiving than one built around perfect timing.

Your Turn

When you imagine the next market drop, what part of you reacts first – your head or your stomach?

What would bring you the most peace: more income, more cash reserves or a clearer plan?

If you could write a one-sentence purpose statement for your investments, what would it say?

👉 Hit reply and share your thoughts – your answers could inspire fellow readers in future issues.

If today’s issue helped you breathe a little easier about the inevitable ups and downs, you can always shout me a coffee on Ko-fi. It keeps the writing warm and the humour caffeinated.

Resources:

Super Investors’ Club (SIC) – monthly membership subscription that aims to make learning about investing more hands-on and accessible to individuals on a mission to become financially free. Join here.

* * * * *

If you’ve ever wished someone would just explain the markets without the noise, this might be worth a look.

I watched this session myself and found it surprisingly clear – no hype, no pressure, just practical ways to approach the market with a calmer, more methodical mindset.

If you’re curious, you can take a peek here:

👉 Explore the Stock Sniper webinar

* * * * *

Options can be a useful tool if you understand how to manage risk – especially in retirement, where protecting capital matters more than chasing big wins.

This workshop focuses on exactly that: the “slow, steady, sensible” side of options.

If you’d like to learn the basics without feeling overwhelmed, here’s the link:

👉 Check out the Options Workshop

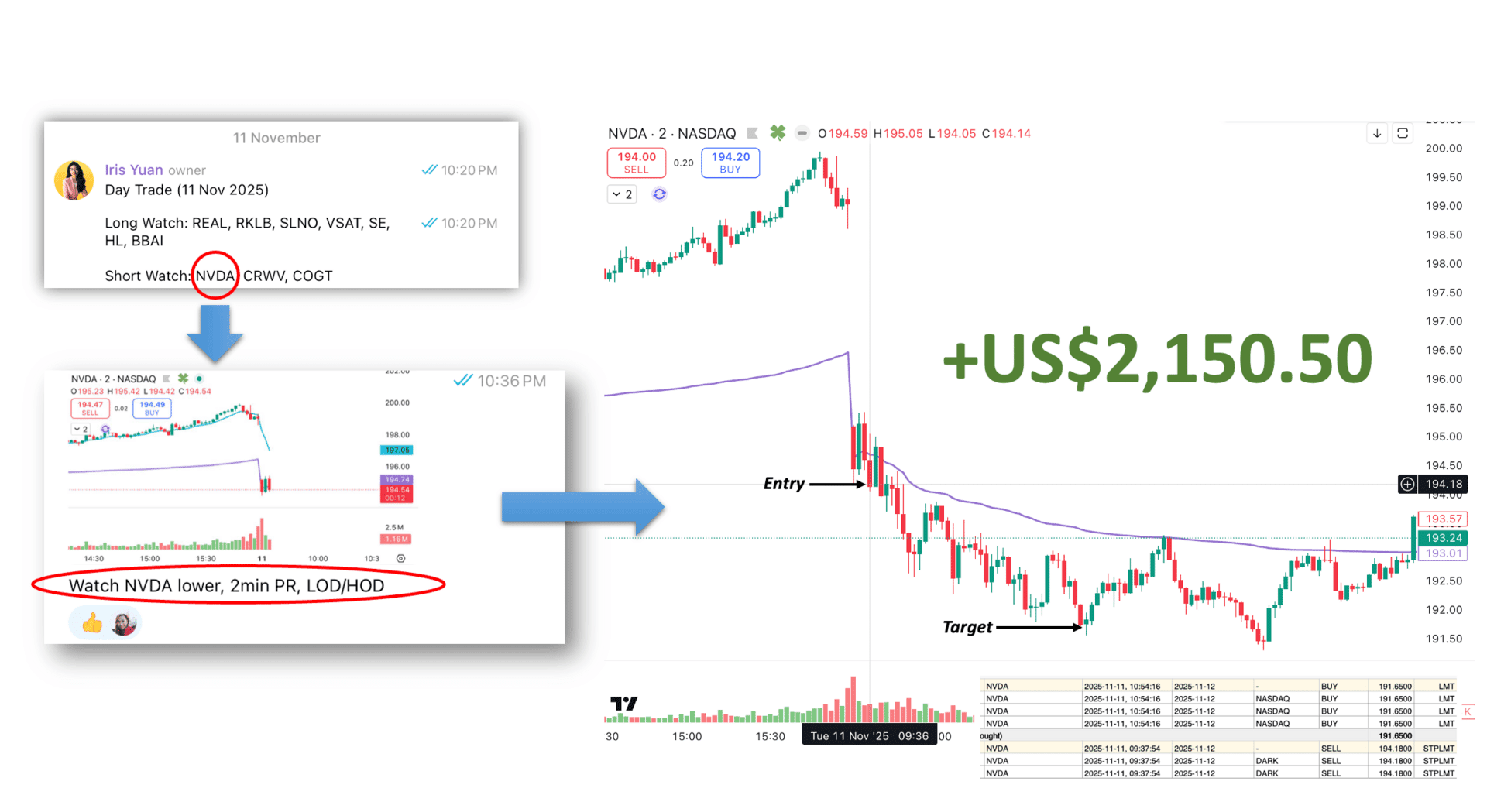

How Iris, the Stock Sniper, made $2,150 in 7 minutes

Last week, Iris executed a pre-planned NVDA trade that hit USD 2,150.50 in profit.

The trade took 80 minutes to reach its target profit but she only spent 7 minutes actively managing it.

How?!

Everything was planned – entry, exit, target, and risk.

She simply clicked once and let the system do the work.

This is what trading looks like when you stop grinding and start systemizing.

Most traders think trading is:

Staring at monitors all day

Chasing every price move

Working harder to make more

Iris proved the opposite. She trades one hour a day and consistently wins. Her core rules are:

Let your Capital work for you: trades may take time to hit – but they should not take your time

Recognise setups, don’t predict: when the signs align, execute

Plan, trust, relax: the system works – you don’t have to

Her results speak for themselves, bull or bear maket:

2022: +$108,176 profit (this, when market was down 22%)

2023: +$109,435 profit

2024: +$112,718 profit

Now, Iris is opening up her 1-hour-a-day trading system in a free 2-hour masterclass where you’ll learn:

Scan → Shortlist → Execute →Log off in 60 minutes

Build a watchlist that does the heavy lifting

Clean-chart rules for faster, clearer decisions

Risk management that keeps losers small and winners running

How to trade even if you are away from your screen

This isn’t theory. It’s the same system that made $2,150 in a day last week, and 6-figure profits year after year.

If you’re ready to stop trading your time for money and take control of your schedule, income and peace of mind, sign up for the Masterclass now!

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

If these insights resonate with you, you’re in the right place. The L-Plate Retiree community is just beginning, and we’re figuring this out together-no pretence, no judgment, just honest conversation about navigating this next chapter.

Subscribe now to receive daily insights, practical tips, and the occasional laugh to help you thrive in retirement. We speak human here-no jargon without explanation, no assuming you’ve been investing since kindergarten.

And if today’s investing note hit the spot, you can buy us a coffee on Ko-fi ☕. Consider it your safest trade of the week-low risk, high return (in good vibes).

Because retirement doesn’t come with a manual… but now it does come with this newsletter.

The L-Plate Retiree Team

(Disclaimer: While we love a good laugh, the information in this newsletter is for general informational and entertainment purposes only, and does not constitute financial, health, or any other professional advice. Always consult with a qualified professional before making any decisions about your retirement, finances, or health.)

Reply