- L-Plate Retiree

- Posts

- When Your Workout Becomes the Problem: Understanding Overtraining Syndrome

When Your Workout Becomes the Problem: Understanding Overtraining Syndrome

More isn't always better – here's how to spot the signs that your exercise routine has crossed from healthy habit to harmful obsession

because retirement doesn’t come with a manual

While I’m quite certain that the risk of overtraining is very low for me, this may be a good reminder someone needs. Balance is the key to life.

CS

Profit-taking pauses three-day rally as energy and financials retreat

The quick scan: US stocks pulled back on Wednesday, January 7th, snapping a three-day winning streak as investors took profits in the sectors that led early 2026's gains. The Dow fell below 49,000 after briefly touching intraday records, while energy and financial stocks – the recent leaders – saw the sharpest declines. Only the Nasdaq managed to stay positive.

S&P 500: -0.34% to 6,920.93 – The broad market index retreated from record highs reached earlier in the session, with financials and energy dragging performance despite strength in technology

Dow Jones: -0.94% to 48,996.08 – Blue-chip stocks gave back 466 points, falling below the 49,000 milestone after touching an intraday record high. Bank stocks led losses with JPMorgan and Bank of America both down more than 2%

NASDAQ: +0.16% to 23,584.27 – The tech-heavy index eked out a small gain as semiconductor stocks held firm following Nvidia CEO Jensen Huang's CES presentation on AI infrastructure and data storage innovations.

What's driving it: Wednesday's pullback reflected classic profit-taking after the Dow's record close Tuesday and strong early-week gains in cyclical sectors. Energy stocks tumbled more than 2% after President Trump's announcement about Venezuelan oil potentially increasing supply, while financials retreated following a JPMorgan downgrade by Wolfe Research. Mixed economic data added uncertainty – JOLTS showed job openings falling sharply to 7.146 million (below the 7.648 million expected), though ISM Services PMI surprised to the upside at 54.0. The divergence between the Nasdaq's modest gain and the Dow's nearly 1% loss suggests investors rotating back toward tech after briefly favoring old-economy sectors.

Bottom line: For L-Plate Retirees, Wednesday's retreat is a useful reminder that markets don't climb in straight lines – even during strong years. After three consecutive days of gains, some consolidation is natural and healthy. The fact that the S&P 500 remains within 1% of all-time highs despite the pullback shows the underlying strength built during early 2026. More tellingly, the divergence between sectors – tech holding steady while energy and financials retreat – demonstrates why diversification matters. When last week's winners stumble, other parts of your portfolio can provide stability. Markets rarely move in unison, which is exactly why we don't put all our chips on one sector's continued dominance.

Stop Waiting & Start Losing Weight Before for Just $179

Finally serious about weight loss? Join 500,000 weight loss patients & lose pounds of fat every week. MedVi provides highly effective GLP-1 treatments, personalized guidance, and everything you need to see real, consistent fat-loss results.

There are no membership fees, nothing confusing, and no insurance required. Just one simple, science-backed program that helps you get healthier each week.

Start today for only $179 and get free shipping.

Read all warnings before using GLP-ls. Side-effects may include a risk of thyroid c-cell tumors. Do not use GLP-1s if you or your family have a history of thyroid cancer. In certain situations, where clinically appropriate, a provider may prescribe compounded medication, which is prepared by a state-licensed sterile compounding pharmacy partner. Although compounded drugs are permitted to be prescribed under federal law, they are not FDA-approved and do not undergo FDA review for safety, effectiveness, or manufacturing quality.

When More Exercise Makes You Weaker

anything taken to an extreme can become bad

The scoop: There's a paradox at the heart of fitness that most people discover the hard way: exercise makes you stronger, until suddenly it doesn't. Cross that invisible line from beneficial stress to excessive strain, and your body stops adapting and starts breaking down. Welcome to overtraining syndrome – the medical condition that turns your healthy habit into your body's worst enemy.

The Problem With "No Pain, No Gain"

We've been sold a narrative that more effort always equals better results. Push harder, train longer, rest less. It's the cornerstone of fitness culture, the mantra that drives athletes and weekend warriors alike. Except biology doesn't work that way.

"All training is designed to challenge our bodies to adapt and improve," explains Dr. David Gazzaniga, an orthopedic surgeon and division chief of sports medicine at Hoag Orthopedic Institute. "But stressing the body without sufficient rest and recovery can flip your progress on its ear."

Overtraining syndrome (OTS) isn't just being tired after a tough workout. It's a medical condition that develops when you exercise too intensely or too often for so long that your body can't recover. The symptoms are physical, mental, and emotional – and recovery can take anywhere from weeks to months.

Here's what makes it particularly insidious: the people most at risk are often the most dedicated. Type-A personalities who pride themselves on consistency and discipline. Retirees who've finally got the time to focus on fitness. Athletes training for that bucket-list marathon. The very traits that make you successful at building a fitness routine can be exactly what drives you into overtraining.

What Overtraining Actually Looks Like

Post-workout soreness typically peaks 24 to 72 hours after exercise and resolves within a week. If soreness persists longer, even at rest, that's a red flag.

But OTS shows up in less obvious ways too. Your workouts feel harder than they should. You're not hitting interval targets you managed easily last month. You feel sluggish and heavy, and recovery between sessions seems to take forever. Sleep becomes elusive despite exhaustion. Your resting heart rate climbs 7-10 beats per minute above baseline. Mood tanks – irritability, anxiety, even depression creep in.

The cruel irony? Many athletes interpret declining performance as a sign they need to train harder, not rest more. So they push through, making everything worse.

There's no single test that definitively diagnoses overtraining syndrome. In fact, some researchers have suggested renaming it "paradoxical deconditioning syndrome" or "unexplained underperformance syndrome" because the root cause isn't always excessive training volume. Sometimes it's inadequate sleep. Or chronic life stress. Or poor nutrition. Or all of the above.

Why Retirees Face Unique Risks

You might assume overtraining only affects elite athletes logging 20-hour training weeks. Not so. Busy lifestyles, high-stress situations, and poor nutrition can hinder recovery to the point where even moderate training triggers overtraining symptoms.

For retirees, the risk factors look different but they're just as real. You've finally got time to exercise consistently – maybe for the first time in decades. That enthusiasm can lead to doing too much too soon. Your 60-year-old body can't absorb training stress the way your 30-year-old body did, even if your mind hasn't caught up to that reality yet.

Add in other life stressors – adjusting to retirement, managing health conditions, caring for aging parents, dealing with the loss of friends – and your recovery capacity diminishes further. You don't have to be training excessively to show signs of overtraining. You just have to be training more than your body can currently handle.

The Recovery Problem

Here's where overtraining syndrome gets truly problematic: recovery isn't measured in days. It's measured in weeks or months. In severe cases, damage can be so extensive that returning to your previous fitness level becomes impossible.

The treatment is brutally simple and psychologically difficult: rest. Complete rest from high-intensity training. Reduction in training volume by 50-70%. Light activity only – walking, gentle yoga, stretching. And patience, which might be the hardest prescription of all.

"Recovery is essential to a successful exercise regimen," notes one sports medicine expert. "It's in that rest phase where you make your gains. And sleep is the single most efficient recovery strategy."

Rest isn't only about getting seven to eight hours of sleep, though that's critical. It's also about active recovery – gentle movement that improves blood flow and mobility without overloading your system. Think walking instead of running. Stretching instead of weight training. Yoga instead of HIIT classes.

Prevention Beats Treatment Every Time

The best way to handle overtraining syndrome is never to develop it in the first place. That requires building recovery into your training as deliberately as you build workouts.

Plan adequate rest days – not "active recovery" that's secretly another workout, but actual rest. Use periodization, varying intensity and volume over time rather than pushing hard constantly. Prioritize sleep like it's part of your training plan, because it is. Track morning heart rate, body weight, and mood to spot warning signs early.

Most importantly, listen to your body and learn what its warning signs sound like. Persistent soreness. Declining performance. Sleep disruption. Mood changes. These aren't weaknesses to push through – they're data points telling you something needs to change.

Actionable Takeaways for L-Plate Retirees:

Track your morning metrics: Before getting out of bed, check your resting heart rate. If it's 7-10 beats per minute above your normal baseline for 5+ consecutive days, scale back training intensity. Add body weight and mood notes to spot patterns.

Schedule rest days as non-negotiable: Put rest days in your calendar with the same commitment as workout days. Rest isn't what you do when you have time – it's what allows your body to adapt and strengthen from training.

Use the 50-hour rule for life stress: If you're experiencing high stress from non-exercise sources (work, family, health issues), reduce training intensity by at least 50% until life calms down. Your body can't distinguish between exercise stress and life stress.

Watch for performance decline, not just soreness: If workouts that felt manageable last month now feel impossible, that's a red flag. Declining performance despite consistent effort is often the first sign of overtraining.

Build a training journal: Record not just what you did, but how you felt during and after. Note sleep quality, energy levels, motivation, and any unusual soreness. Patterns become obvious when you write them down.

Don't ramp up too fast after a break: Returning from vacation or illness? Ease back in at 50-70% of your previous intensity for at least a week. The fitness you built isn't going anywhere, but rushing back can trigger overtraining.

Your Turn:

Have you ever pushed through fatigue or declining performance thinking you just needed to train harder, only to feel worse?

What stops you from taking rest days when you know you probably should – guilt, fear of losing progress, or something else?

How do you currently tell the difference between good soreness that means you're getting stronger and bad soreness that signals a problem?

👉 Hit reply and share your story – your insights could inspire fellow readers in future issues.

If this counterintuitive approach to running faster resonates with you, consider supporting me on Ko-fi. Your contribution helps us keep sharing the science-backed strategies that challenge conventional wisdom – because sometimes the smartest path forward means deliberately slowing down.

Invest 360 (FREE event!)

As 2026 approaches, the question quietly sitting in the back of many portfolios is a simple one – what now?

Markets have moved fast. Strategies that worked a few years ago feel less certain. And for many pre-retirees and retirees, the margin for error matters more than ever.

The investors who tend to do best in these transitions aren’t the ones chasing the loudest headlines – they’re the ones stepping back and asking for a complete picture.

That’s exactly what Invest 360 is designed to deliver.

Rather than focusing on a single asset class or a single strategy, this one-day live online event brings together eight experienced investors to share how they’re positioning across markets heading into 2026 – what they’re leaning into, what they’re cautious on, and how they think about risk when capital preservation matters just as much as growth.

If 2025 was the year you sharpened your investing skills, Invest 360 is about turning that learning into clear positioning and execution.

Why this event is different

Most investing events zoom in on one corner of the market.

Invest 360 deliberately zooms out.

You’ll hear perspectives across all major asset classes, helping you understand how the pieces fit together – not just what’s exciting in isolation.

Just as importantly, this isn’t theory-heavy content. Several speakers are opening the hood on their own portfolios, sharing:

What worked in 2025

What didn’t – and why

The lessons they’re carrying into 2026

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

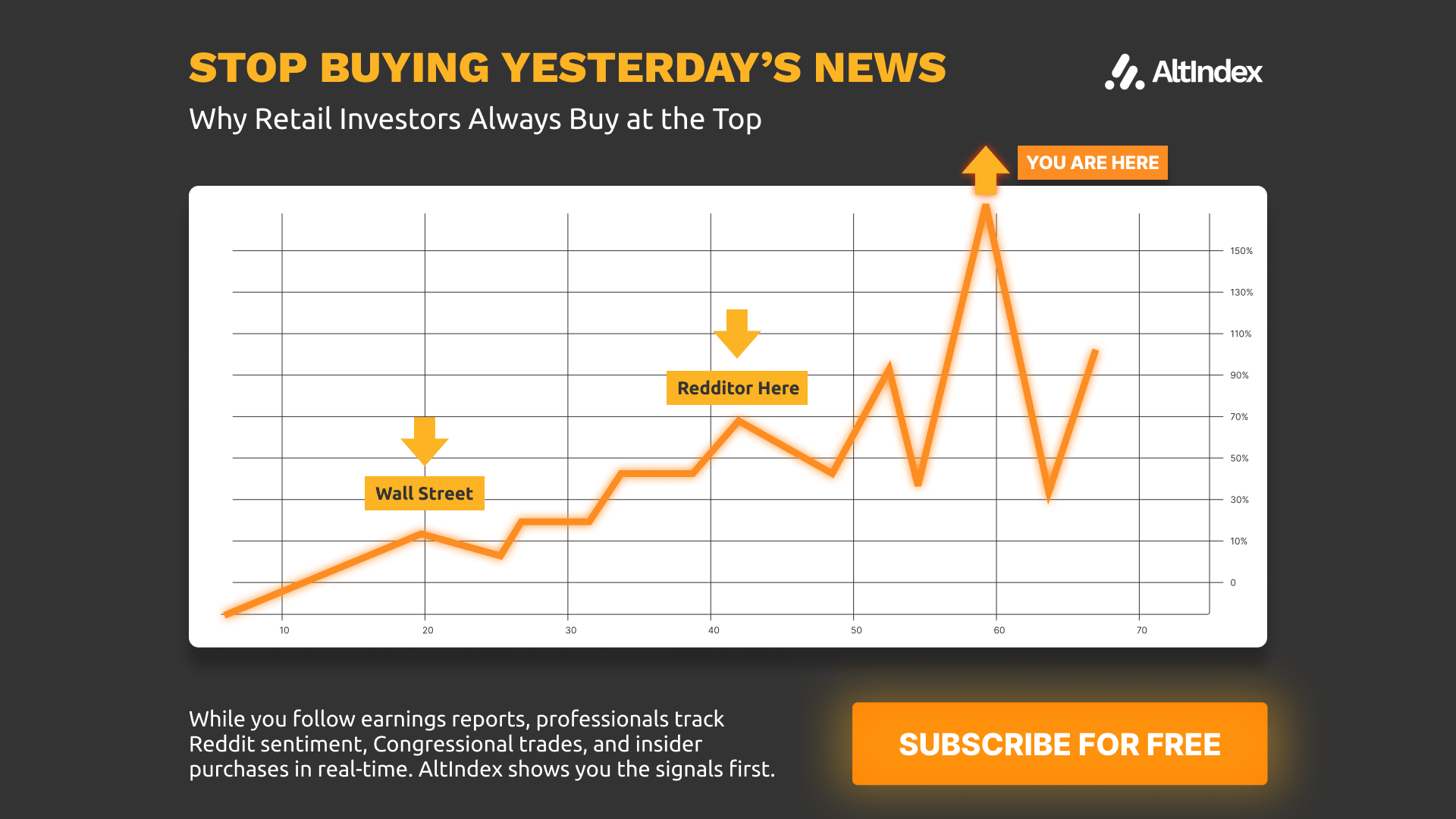

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

If these insights resonate with you, you’re in the right place. The L-Plate Retiree community is just beginning, and we’re figuring this out together – no pretense, no judgment, just honest conversation about navigating this next chapter.

Subscribe now to receive daily insights, practical tips, and the occasional laugh to help you thrive in retirement. We speak human here – no jargon without explanation, no assuming you’ve been investing since kindergarten.

And if today’s investing note hit the spot, you can buy us a coffee on Ko-fi ☕. Consider it your safest trade of the week – low risk, high return (in good vibes).

Because retirement doesn’t come with a manual… but now it does come with this newsletter.

The L-Plate Retiree Team

(Disclaimer: While we love a good laugh, the information in this newsletter is for general informational and entertainment purposes only, and does not constitute financial, health, or any other professional advice. Always consult with a qualified professional before making any decisions about your retirement, finances, or health.)

Reply