- L-Plate Retiree

- Posts

- Why Market Predictions Fail: What a Bike-Fit Study Taught Me About Investing

Why Market Predictions Fail: What a Bike-Fit Study Taught Me About Investing

Fifty experts, one cyclist and zero agreement – a perfect metaphor for stock forecasts and financial “gurus”

because retirement doesn’t come with a manual

anyone’s tried “professional” bike fitting?

A few nights ago, I fell down a rabbit hole – not of market charts or economic forecasts – but of bike-fitting videos. Yes, bike-fitting. Yeah, the Wife also commented that I have a wide spectrum of interests…

One line from the video absolutely floored me: fifty professional bike fitters looked at the same rider, the same footage, the same data – and still couldn’t agree on the “perfect” position. Same inputs, wildly different outputs.

And suddenly, I thought: hey, this sounds familiar. Ah yes, the stock market!

Because just like bike fitting, markets wear the aura of science: numbers, candlestick patterns, Greek letters. Then they speak in lore: tech always wins, gold protects you, cash is trash. And finally, they deliver all of it with absolute guru-level confidence.

Put those three together – science-y language, lore-like rules, and bold certainty – and even a guess can start sounding like a guarantee.

It reminded me of a joke I heard from working in banks: when markets go up, the pitch is “market is flying! you should buy!”; when markets fall, the pitch is “market is so cheap now! you should buy!”. Up, down, sideways – the advice somehow stays the same: buy.

And yet – as that video pointed out – precision stops where human judgement begins. That applies to riders on a bike, and investors in the market. Everyone is looking at the same S&P chart, the same inflation print, the same earnings reports. And somehow fifty smart analysts can come away with fifty-one different conclusions.

Here’s another interesting anecdote: a bike-fit researcher tested nine reputable studios. All used proper tools. All had training. And yet the same cyclist ended up with nine different “optimal” positions.

Markets aren’t much different.

And the video’s punchline hit hard: certainty sells better than complexity.

That sentence deserves to be on a t-shirt – for investors, not cyclists.

Because deep down, we all want the expert who says “this is the way”. But the truth is that investing is interpretation. Strategy is interpretation. There is no single saddle height for your portfolio.

Which brings me to what I think is the real wisdom buried inside all that bike-fit chaos:

when evaluating a system, look for the reasoning.

Good practitioners – in cycling or investing – don’t sell rules. They teach you how to think.

Markets will always have gurus selling templates: buy tech forever, only dividend stocks, only bonds, only cash, only gold, only crypto. The list goes on. But the moment someone’s method becomes universal and absolute, it stops being expertise and starts becoming mythology.

Your job – my job – is to stay curious and keep asking better questions.

That’s where the real edge lives.

In cycling, the advice was simple: start with the smallest testable, reversible change.

And honestly, that applies beautifully to investing too.

Before you overhaul your entire portfolio because someone on TV spoke confidently – take the smallest step first. See if it works for you. Observe, adjust, iterate.

In an unregulated industry like bike fitting, confidence can overshadow credibility.

In markets, it’s no different. If a claim scales to everyone without nuance, treat it as a hypothesis – not gospel.

The markets don’t reward the person with the fanciest chart or the loudest conviction.

They reward the person who can sift signal from noise, adjust with humility, and stay the course without letting every guru shake their handlebars.

And if you take nothing else from today’s ramble, take this:

certainty is comforting, but curiosity compounds.

Your turn:

Where in your financial life have you been chasing certainty instead of clarity?

Which confident market “rule” might actually be more lore than law?

What small, low-risk adjustment could you test this week?

👉 Hit reply and share your thoughts – I’d love to hear what’s resonating with you.

☕ If today’s musing made you rethink what it means to stay ready, you can shout me a coffee on Ko-fi.

Could you go from being $50k in debt to $20k?

If you feel you're languishing in debt, debt relief companies can take over negotiations with your creditors and potentially get them to accept up to 60% less than you owe. Sounds too good to be true? Our debt relief partners have already helped millions of Americans just like you get out of debt. Check out Money’s list of the best debt relief programs, answer a few short questions, and get your free rate today.

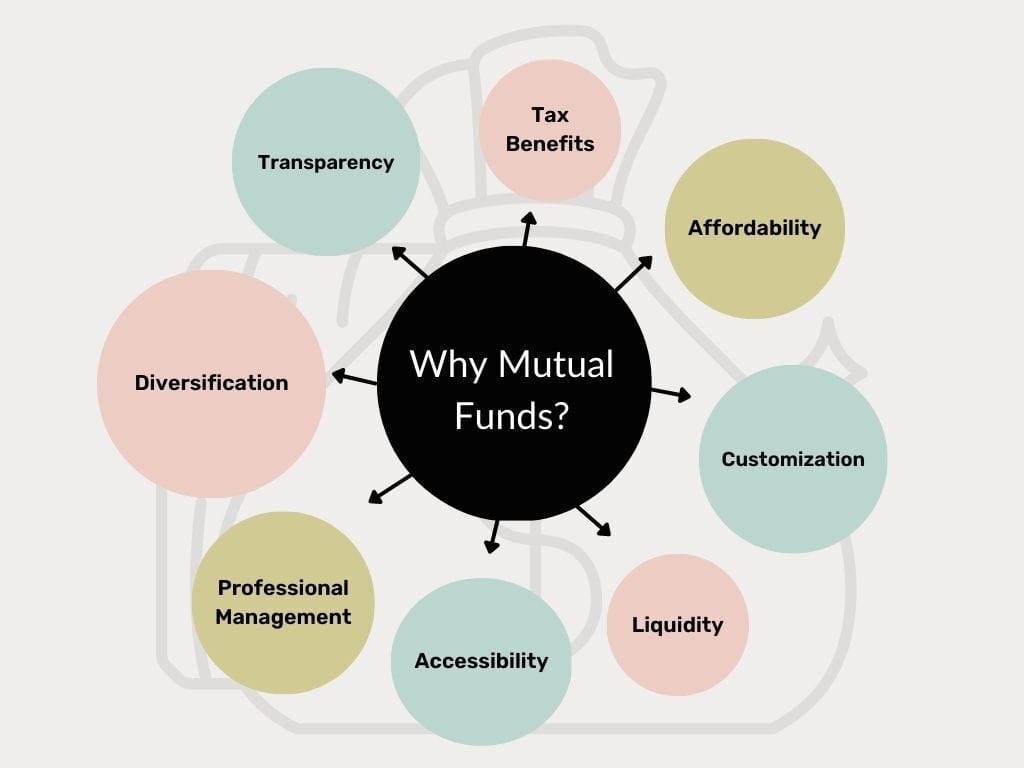

Mutual Funds – The Original "Done-For-You" Investment

the benefits of investing in mutual funds

Alright, L-Plate crew! We've been exploring various investment vehicles, from individual stocks and bonds to real estate and the modern marvels of ETFs. Today, let's talk about the granddaddy of "set it and forget it" investing: the Mutual Fund. This investment vehicle has been a cornerstone for everyday investors who wanted a diversified portfolio without the headache of picking individual stocks and bonds, aligning perfectly with the Foundations of Investing principle of diversification.

Think of a mutual fund as a financial potluck dinner: everyone chips in a bit of money, and a professional chef (the fund manager) goes out and buys a whole bunch of different ingredients (investments) to create a delicious, diversified meal. When you buy into a mutual fund, you're buying shares of the fund itself, not the individual stocks or bonds it holds. The fund is professionally managed, and you can choose from a dizzying array of options: funds that focus on stocks, bonds, a mix of both, or even specific sectors or countries. There are Equity Funds for growth, Fixed Income Funds for stability, and Balanced Funds for a bit of everything, each offering a different risk and return profile as we discussed in Risk and Return Fundamentals.

One of the key differences between mutual funds and ETFs is how they're priced. Mutual funds are priced just once a day, at the end of the trading day, based on their Net Asset Value (NAV). So, you can't trade them throughout the day like you can with an ETF. This isn't necessarily a bad thing – in fact, it can help you avoid making impulsive decisions based on short-term market noise, which is a valuable aspect of managing your risk tolerance.

You might also hear about Closed-End Funds. These are a bit different. They have a fixed number of shares that trade on an exchange, just like a stock. This means their price can be different from their NAV – they can trade at a "discount" (cheaper than their underlying assets) or a "premium" (more expensive). They're a bit more complex, and understanding their unique pricing mechanism is part of the deeper dive into investment vehicles.

Mutual funds are still a fantastic option for many investors, especially if you're looking for a hands-off approach that fits your Personal Financial Assessment and investment goals. They offer professional management, instant diversification, and a wide range of choices. Just be sure to keep an eye on the fees, as they can vary quite a bit from fund to fund, impacting your overall returns.

L-Plate Takeaways

Mutual Funds are a potluck: You pool your money with other investors, and a professional manager buys a diversified portfolio.

Priced once a day: Unlike ETFs, mutual funds are priced at the end of the trading day, which can help manage impulsive trading behavior and risk.

A fund for every flavour: There are thousands of mutual funds to choose from, allowing you to match your risk tolerance and personal financial goals.

Watch the fees: Professional management comes at a cost. Be sure to compare the expense ratios of different funds before you invest, as this impacts your net returns.

A classic for a reason: Mutual funds remain a reliable and straightforward way to build a diversified portfolio, especially for those seeking a managed approach.

The L-Plate Retiree community is just beginning, and we’re figuring this out together – no pretense, no judgment, just honest conversation about navigating this next chapter.

Subscribe now, or share it with a friend, to get weekly insights, practical tips, and the occasional laugh to help you prepare for or thrive in retirement. Unlike other newsletters that assume you already know everything, we keep it simple and human.

And if today’s lifestyle musings brightened your day, you can toss a coffee into our Ko-fi tip jar ☕. Think of it like leaving a tip for your favourite busker – only this busker writes about retirement.

Because retirement doesn’t come with a manual… but now it does come with this newsletter.

The L-Plate Retiree Team

(Disclaimer: While we love a good laugh, the information in this newsletter is for general informational and entertainment purposes only, and does not constitute financial, health, or any other professional advice. Always consult with a qualified professional before making any decisions about your retirement, finances, or health.)

Reply