- L-Plate Retiree

- Posts

- Why My New Year's Resolutions Sound Different This Year

Why My New Year's Resolutions Sound Different This Year

You can't resolve away by will what you built up by habits – so I'm changing what I'm resolving

because retirement doesn’t come with a manual

the marshmellow test - ultimate test for willpower! - age-adjusted

🎉🎊🎉Happy New Year 2026!!🎊🎉🎊

So my daughter asked about my New Year's resolutions this week. Caught completely off guard – because who actually thinks about these things before January 3rd? – I defaulted to the greatest hits: save more money, eat healthier, exercise more regularly.

Standard stuff. Safe stuff. The same three things I've probably declared every January since 2020, with roughly the same success rate as my attempts to understand TikTok.

But something stuck with me afterward – a thought I heard somewhere (probably while scrolling through motivational quotes when I should've been working): You cannot resolve away by will what you have built up by habits.

Ouch. You can't just decide to override patterns built over years. Declaring "I'll exercise more" doesn't magically override the habit of choosing Netflix over literally anything involving movement. Resolving to "eat healthier" doesn't make kale suddenly materialize when your habit is grabbing whatever requires the least effort.

So this year, I'm trying something different: instead of resolving what I want to achieve, I'm resolving to build the habits that'll actually get me there. Revolutionary, I know.

Not "save more money" – but the habit of reviewing and systematizing my investing and trading. Because apparently just vaguely hoping my portfolio improves isn't a strategy, despite years of testing this theory.

Not "eat healthier" – but sticking to intermittent fasting more strictly. Which sounds impressive until you realize it mostly means "stop eating that midnight snack while telling yourself it's technically still dinner if you haven't slept yet."

Not "exercise more" – but reviewing my weekly schedule to actually fit in runs and bike rides, building the habit before winter arrives. Because nothing tests a newly formed habit quite like Melbourne winter convincingly arguing that staying under a blanket is the superior life choice. If the habit survives winter, it survives anything. If it doesn't... well, at least I tried in the warm months.

The shift feels small but significant. Goals are destinations. Habits are the systems that get you there. One requires sustained willpower (which runs out approximately 15 minutes after you make the resolution). The other requires repetition until it becomes automatic (which requires no willpower, just stubbornness and possibly reminders on your phone).

I'm not abandoning ambition. I'm just being honest that willpower alone hasn't worked historically – and by "historically" I mean "every previous January when I declared similar intentions with identical confidence and predictable results."

What might actually work? Building small, repeatable actions that compound without me having to constantly negotiate with myself about whether today is "a good day" to start.

So 2026: more systems, fewer declarations. More daily practices, fewer grand pronouncements. More automation, less relying on future-me to suddenly develop discipline that current-me clearly lacks.

Will it work? We'll find out. But at least this time I'm building the infrastructure instead of just wishing for different results while doing the exact same things.

And if nothing else, it gave me a better answer for my daughter than "the usual stuff."

Your Turn:

Which of your past New Year's resolutions failed because you were trying to willpower through them rather than building systems that made them automatic?

What's one habit you've accidentally built over the years that you'd never consciously "resolve" to do – and what does that tell you about how habits actually form?

If you could only establish one small daily habit in 2026 that would compound into significant change, what would it be – and what's stopping you from starting it today instead of Monday?

👉 Hit reply and share your thoughts – I’d love to hear what’s resonating with you.

From Resolutions to Results: Why Systems Beat Willpower (Even in Investing)

My confession about building habits instead of declaring resolutions this week reminds me why Invest360 on January 10 matters. While I'm fumbling through the difference between "I want to save more" and "I will systematize my investing weekly," here's an event that shows you what actual investing systems look like in practice.

Because here's what this habits-over-willpower revelation taught me: you can't willpower your way to better investment returns any more than you can willpower your way to fitness. What works? Learning from people who've built the systems, tested them through 2025's volatility, and are sharing what actually worked (and what didn't).

Invest360 – January 10, 2026

One day. Every major asset class. Top investors from stocks, options, forex, crypto, and real estate revealing their actual 2025 results and their gameplans for 2026.

This isn't another single-strategy seminar. It's a complete 360° view of where the smartest money sees opportunities in the new market cycle – before the crowd catches on.

What You'll Get:

Exclusive portfolio reveals (actual trades, wins, losses from 2025)

Insider 2026 gameplans from top investors across all asset classes

A clear execution blueprint to position your portfolio early

Insights to identify which strategies actually fit your goals

Date: January 10, 2026

Time: 9:00AM – 5:00PM (SGT+8)

Location: Live on Zoom

Critical detail: No replays. Full insights revealed live only. Seats are extremely limited.

☕ If today’s musing served up a thought to chew on, you can shout me a coffee on Ko-fi. It keeps this cosy corner of wisdom well-fuelled.

Earn Your Certificate in Private Equity on Your Schedule

The Wharton Online + Wall Street Prep Private Equity Certificate Program delivers the practical skills and industry insight to help you stand out, whether you’re breaking into PE or advancing within your firm.

Learn from Wharton faculty and industry leaders from Carlyle, Blackstone, Thoma Bravo, and more

Study on your schedule with a flexible online format

Join a lifelong network with in-person events and 5,000+ graduates

Earn a certificate from a top business school

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

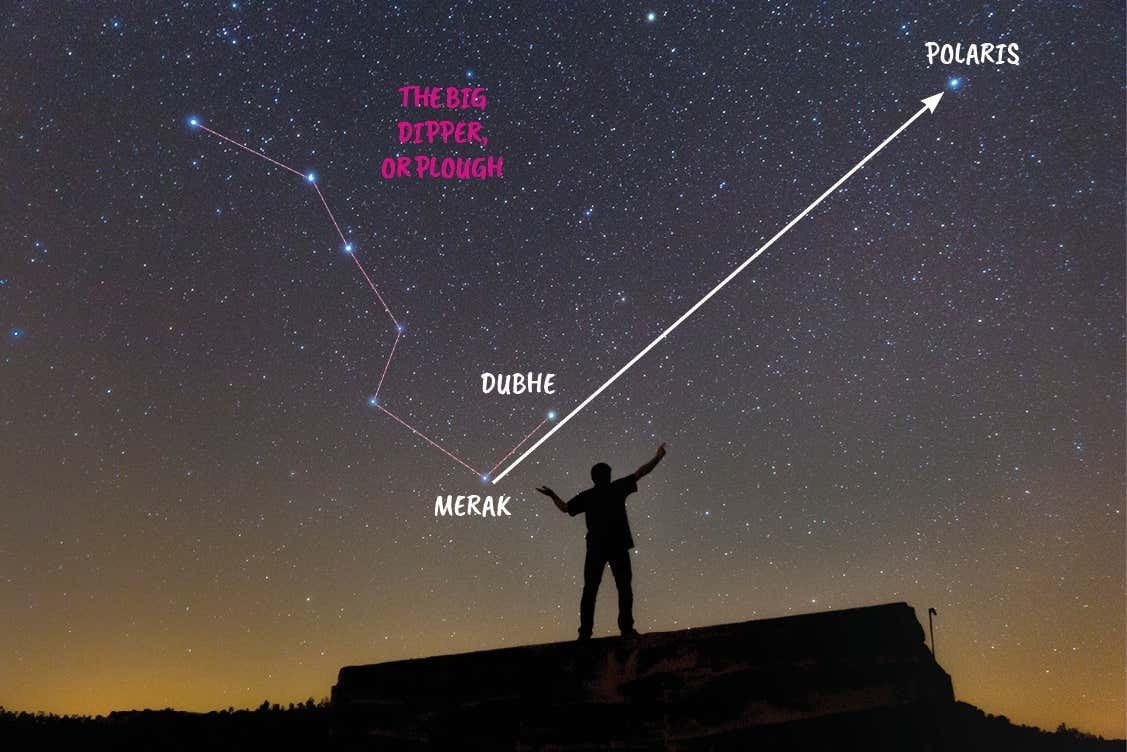

The Blueprint – Why Asset Allocation is Your North Star

the north star has been used for navigation for ages

Welcome back, L-Plate Retirees! We've covered the Foundations of Investing sorted out your Personal Financial Assessment, understood Risk and Return, and explored the whole garage of Investment Vehicles. Now, it's time to put it all together with Asset Allocation. Think of this as the blueprint for your entire financial house. It's not about picking the perfect brick (stock), but deciding how much of your house should be made of bricks (stocks), concrete (bonds), and glass (cash).

Asset Allocation is simply dividing your portfolio among different asset categories – stocks, bonds, cash, and maybe real estate. Why is this so important? Because studies show that where you put your money (the allocation) is the single biggest factor determining your long-term return and how bumpy the ride will be. It's the ultimate risk management tool, a direct application of your risk tolerance.

There are two main ways to approach this:

Strategic Asset Allocation (SAA): This is your "set it and forget it" long-term plan. Based on your time horizon and risk tolerance, you set target percentages (e.g., 60% stocks, 40% bonds) and stick to them. You periodically rebalance to bring the portfolio back to these targets. This is the bedrock for most L-Plate Retirees – it's disciplined, low-cost, and keeps emotions out of the driver's seat.

Tactical Asset Allocation (TAA): This is for the active drivers. TAA involves making temporary, short-term tweaks to your SAA to try and capitalize on market opportunities. For example, if you think bonds are temporarily undervalued, you might bump your bond allocation up to 45% for a few months. TAA is riskier, requires more monitoring, and is generally best left to the professionals, especially in volatile global markets.

For us L-Platers, SAA is our North Star. It's the disciplined approach that ensures your portfolio is always aligned with your long-term goals from your Personal Financial Assessment.

L-Plate Takeaways:

Allocation is Key: Asset allocation is the most important decision you'll make, determining most of your long-term return and risk.

SAA is Your Friend: Strategic Asset Allocation is the disciplined, long-term approach that keeps your portfolio aligned with your goals and risk tolerance.

TAA is Advanced: Tactical Asset Allocation is a short-term strategy to exploit market moves. It's generally riskier and requires more active management.

Diversification is the Goal: By combining different asset classes, you reduce the overall portfolio volatility, a core principle of Foundations of Investing.

Set the Blueprint: Decide on your long-term SAA based on your time horizon and risk comfort, and commit to it.

Feel Better Today

If you feel stressed, anxious or depressed, you do not have to suffer alone. With BetterHelp, you can connect with a therapist who fits your needs and schedule. No commute, no waiting rooms - just real, meaningful help. Get started today - therapy has never been easier. Take 25% off your first month without HSA & FSA eligible service.

This email was delivered by a third-party, on behalf of BetterHelp. Copyright © 2025 BetterHelp. All Rights Reserved. 990 Villa St, Mountain View, California, United States.

The L-Plate Retiree community is just beginning, and we’re figuring this out together – no pretense, no judgment, just honest conversation about navigating this next chapter.

Subscribe now, or share it with a friend, to get weekly insights, practical tips, and the occasional laugh to help you prepare for or thrive in retirement. Unlike other newsletters that assume you already know everything, we keep it simple and human.

And if today’s lifestyle musings brightened your day, you can toss a coffee into our Ko-fi tip jar ☕. Think of it like leaving a tip for your favourite busker – only this busker writes about retirement.

Because retirement doesn’t come with a manual… but now it does come with this newsletter.

The L-Plate Retiree Team

(Disclaimer: While we love a good laugh, the information in this newsletter is for general informational and entertainment purposes only, and does not constitute financial, health, or any other professional advice. Always consult with a qualified professional before making any decisions about your retirement, finances, or health.)

Reply